Licensed Money Lender Singapore – Low Interest, Quick Approval

In today’s fast-paced world, managing finances efficiently is more important than ever. Whether it’s to handle an unexpected expense, fund a personal goal, or support a growing business, the need for Licensed Money Lender Singapore services has never been more apparent. At some point, many of us find ourselves needing quick financial support — and we want it with low interest, flexible terms, and a process that doesn’t feel like walking through fire. That’s where Singapore’s licensed money lenders come in — offering not just funds, but financial breathing room, clarity, and peace of mind.

Understanding the Role of Licensed Money Lenders

In Singapore, licensed money lenders play a crucial role in providing regulated financial assistance to individuals who might not qualify through traditional banking channels. These lenders are governed by the Ministry of Law, which ensures they operate within a strict legal framework, making them a reliable alternative for borrowers. Unlike unlicensed lenders or loan sharks, licensed money lenders in Singapore offer transparency, structured repayment plans, and reasonable rates — eliminating the guesswork and risk that often comes with informal borrowing.

What Makes a Money Lender ‘Licensed’?

A licensed money lender is recognized and approved by the Registry of Moneylenders under the Ministry of Law. This registration is not a one-time formality — lenders must comply continuously with the guidelines, such as capping interest rates and ensuring ethical collection practices. What that means for borrowers like us? We’re guaranteed a safer, fairer lending experience.

Quick Loan Approvals: Why Speed Matters

Let’s be honest — when you’re seeking a loan, it’s usually not for something that can wait weeks. You might be dealing with a medical emergency, a family matter, or a business opportunity that’s slipping through your fingers. That’s why licensed money lenders in Singapore often shine where banks can’t: quick loan approvals.

Many lenders offer same-day approvals. Some can disburse the loan amount within an hour of application — given that your documents are in order. That speed doesn’t come at the cost of safety or structure either. These institutions are bound by regulation, so while they move quickly, they don’t skip the due diligence. It’s fast finance without the risk.

Documents You’ll Need

Generally, you’ll only need a few essential documents:

-

NRIC or Passport

-

Proof of income (payslip or employment letter)

-

Proof of residency (utility bill or tenancy agreement)

Self-employed? No problem — many lenders accommodate with alternative documentation like tax assessments or CPF statements. Again, they’re built to work with real-life situations.

Low Interest Doesn’t Mean Low Value

“Low interest” isn’t just a buzzword. Singapore’s licensed money lenders are capped by law on how much they can charge — currently up to 4% per month on the outstanding loan principal. That’s significantly more affordable than payday lenders or illegal money lenders, and even more flexible in many cases than credit cards.

What sets them apart further is transparency. No hidden fees, no sudden penalties. Before you sign anything, you’ll know:

-

The interest rate

-

The repayment schedule

-

The total cost of the loan

We appreciate when money lenders show respect for our intelligence and needs — and transparency is how they do that.

Who Can Apply for Loans?

One of the most inclusive aspects of licensed money lenders in Singapore is that they cater to a broad audience:

-

Locals, PRs, and even foreigners working in Singapore

-

Salaried employees and self-employed individuals

-

Those with perfect credit… and those still rebuilding

Minimum income requirements start as low as $10,000 annual income for foreigners, and $20,000 for Singapore citizens or PRs. So, even if a bank has turned you away, you’re not out of options.

Common Loan Types Available

-

Personal Loans: For emergencies, bills, or lifestyle purchases.

-

Business Loans: For small business owners needing quick capital.

-

Foreigners’ Loans: Tailored for expats needing financial flexibility.

-

Debt Consolidation: Combine multiple debts into a single, manageable repayment.

Each comes with flexible terms — often from 1 to 12 months — depending on the lender and your financial profile.

What to Expect During the Application Process

The process is designed to be simple and efficient. Here’s a typical journey:

-

Apply online or in-person with your documents

-

Receive a consultation — where terms, options, and your questions are handled

-

Loan approval & signing — everything is written, clear, and verified

-

Immediate disbursement — funds are usually transferred to your bank or given in cash

From start to finish, this process can take as little as an hour. That’s not just fast — that’s financial empowerment.

How SKM Credit Fits the Picture

Now let’s talk real — not all licensed money lenders are the same. SKM Credit stands out for a few simple reasons:

-

Fast, no-nonsense approvals

-

Friendly, knowledgeable service

-

Fair rates and flexible plans

They’ve built a reputation for trust, clarity, and customer-first lending. You don’t have to guess. You don’t have to stress. You get what you need — and you get it fast.

Why People Are Choosing Licensed Lenders Over Banks

Banks will always have their place, but they aren’t always accessible or flexible. In contrast, licensed lenders offer:

-

Faster approvals

-

Easier criteria

-

Human support — not just a chatbot

For many Singaporeans and residents, that’s the difference between anxiety and action. And with licensed lenders, action comes with accountability.

Common Misconceptions (Busted)

“Licensed lenders are shady.”

False. If they’re licensed, they’re legally bound to transparency and fairness.

“Interest rates are crazy.”

Wrong again. With caps in place, rates are both controlled and often lower than credit cards or late payment fees.

“Only the desperate take loans.”

Let’s kill that stigma. Financial flexibility is smart — and seeking help from the right sources is empowering, not embarrassing.

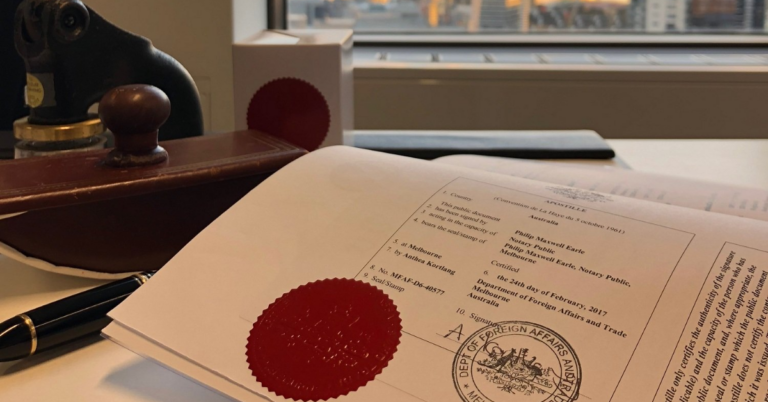

Wrapping It All Up: Confidence in Every Contract

The truth is, needing a loan doesn’t mean you’ve failed — it means you’re moving. You’re fixing, building, investing, adapting. Choosing a licensed money lender Singapore like SKM Credit gives you control and confidence. You’re not just signing papers. You’re choosing clarity, speed, and respect.

We all deserve a financial system that works with us — not against us. And thankfully, in Singapore, licensed money lenders are offering just that.